Price Increases 2022

Share

PRICES FOR ALL COFFEES WILL INCREASE BY 15% FROM OCTOBER 1, 2022.

We don’t make this decision lightly, but it’s essential to the roastery’s existence. We have spoken with other roasteries and we know that these changes are in line with price increases throughout the industry. We want to share the reasons behind the increase in as much detail as possible.

Here is why:

-coffee prices have risen.

-our costs of production have increased.

GREEN COFFEE PRICES:

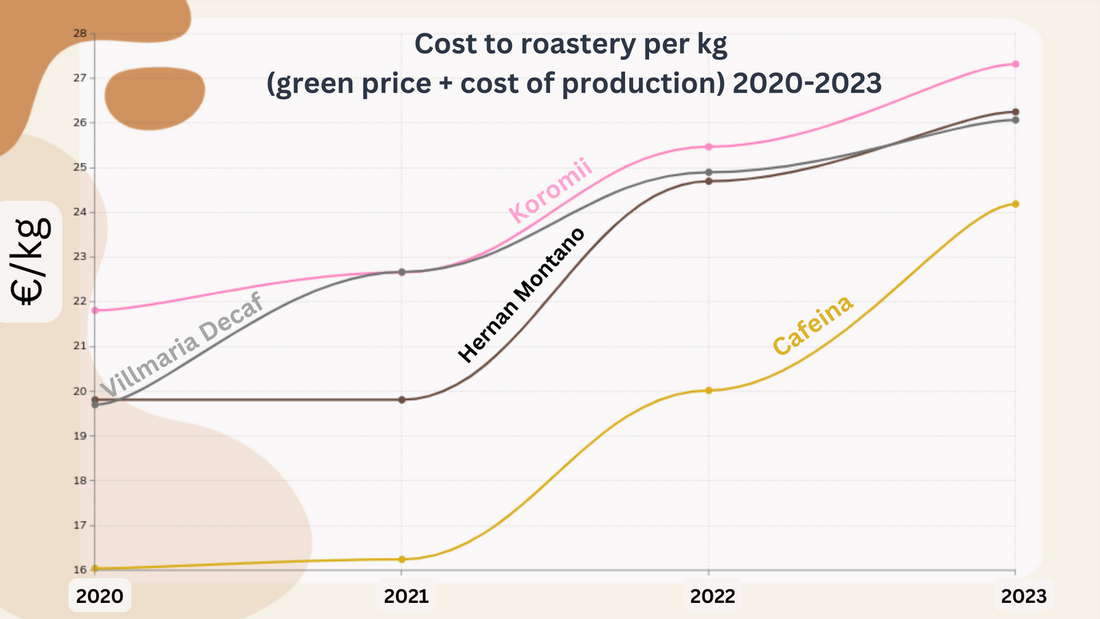

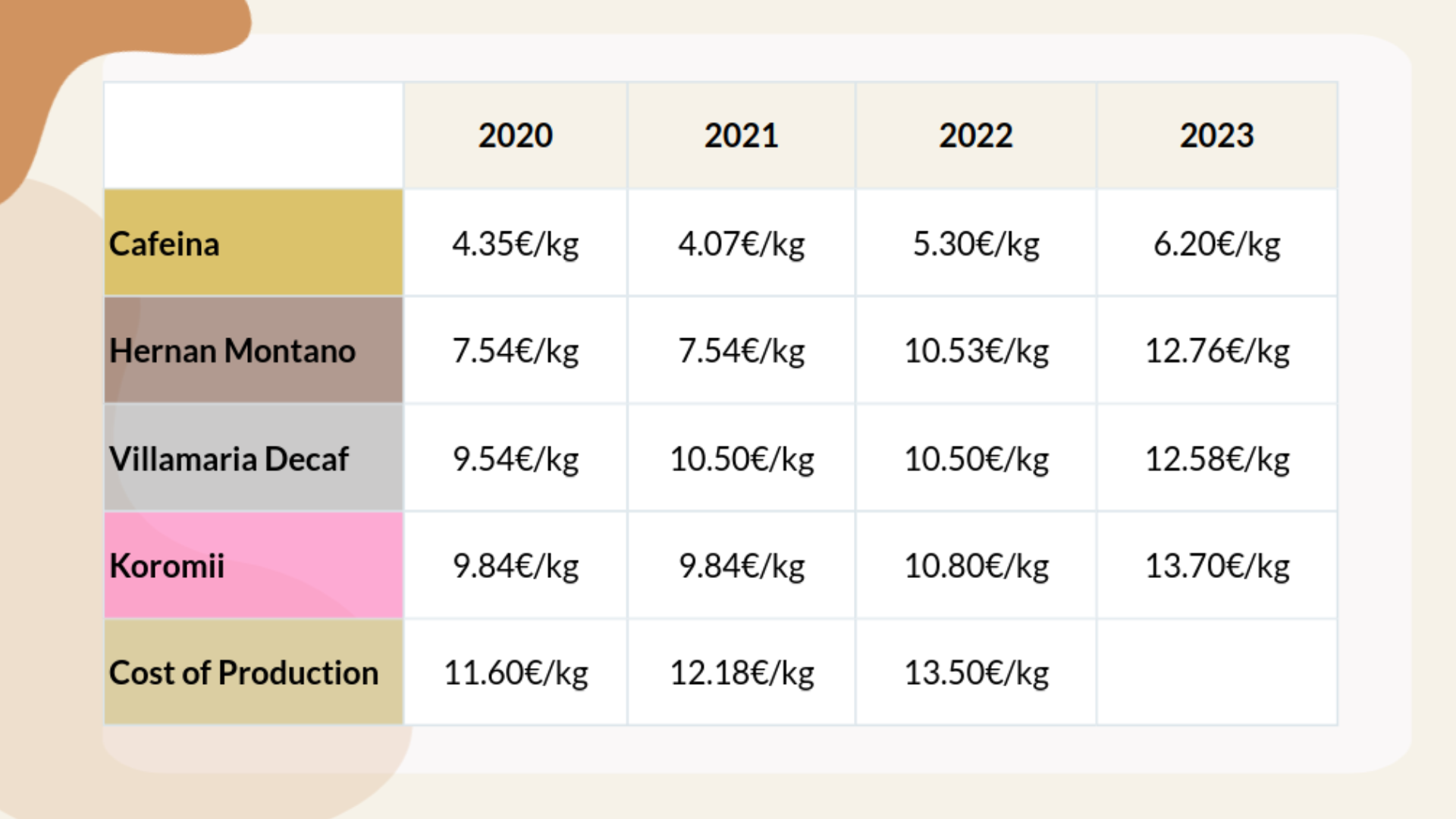

The price we pay for our four key coffees: Cafeina, Koromii, Hernan Montano, and Villamaria Decaf increased by an average of 19% between 2020 and 2022. We know that these prices will increase by another 22% between 2022 and 2023, making a total increase of 45% over four years.

We are seeing similar price increases for every single coffee that we purchase.

The table below shows the price that we paid for four key green coffees and the total cost of production (wages, rent, energy bills, packaging etc.) per kg since the year 2020.

Coffee is usually harvested six months before we start roasting it, so please note that these numbers relate to the year that we purchase and use the coffee, not necessarily to the year that it was harvested. We purchase the vast majority of our coffees before they leave their country of origin (this is called pre-shipment purchasing), so we already know what prices we will pay for coffees in 2023.

The graph below shows the weighted average cost of all of these coffees, compared to the average weighted price at which we sell them.

As you can see, even with an increase to our blend prices in May this year, our costs have begun to far outpace our prices.

The term “weighted average” takes into account the amount of each coffee that we have purchased and sold (or predict to sell). For example, Cafeina makes up approximately 40% of the total coffee that we roast, the Koromii 18%, Hernan Montano 10%, and Villamaria decaf 5%. Because the Cafeina is our most affordable coffee and we roast more of it per week than any other, this brings that average weighted price per kg down. We see this metric as the most accurate reflection of how our expenditure relates to our income.

WHY IS GREEN COFFEE MORE EXPENSIVE?

HIGHER PRICES FOR FARMERS

Let’s start with the (mainly) good news.

We’re delighted to see that farmers are receiving significantly higher prices for their coffees in many of the world’s coffee-producing countries. Paying producers higher prices every year is built into our business model, but this year’s price increases have also been driven by several external factors.

The average price paid to coffee farmers in Colombia has increased dramatically in the last two years. This is partially due to increased demand from the Colombian domestic market, forcing exporters to pay higher prices to secure coffees. Until the early 2000s trade regulations meant that only defective beans, or “Pasilla coffee” could be drunk within the country. The country’s best coffees were reserved exclusively for export. Since the law’s abolition, specialty coffee has grown slowly into a thriving scene. In 2021 the World Barista Champs was won by Colombia’s Diego Campos, only the third time in 20 years that the competition has been won by a competitor from a coffee-producing country.

As demand from Colombian-based roasteries grows, farmers are increasingly able to sell their coffees domestically for the same, if not higher, prices than international traders can offer. Given the international logistics crisis, the incentive to sell locally is even higher. In many ways, this is a dream-case scenario: local communities retain more value from the coffee that they produce, and increased competition means that farmers can demand higher prices for their crops.

HOWEVER, HIGHER PRICES FOR FARMERS HAVE BEEN COMPROMISED BY HIGHER COSTS.

The cost of fuel and fertilizer has skyrocketed in the last 12 months. In Brazil, fertilizer prices are up 60% from 2020 and fuel prices are up 15%. Farmers in Colombia, Kenya, Uganda, Timor-Leste, and throughout the coffee-growing world are facing similar increases.

In 2019 Russia was the world’s largest exporter of nitrogen and the third largest producer of phosphate. Alongside potash, phosphate and nitrogen are the primary ingredients in fertilizers used by the coffee industry. In Kenya, the price of fertilizer was reported to have increased from $35US per 50kg bag to $60US in the year March 2021 to March 2022. Although many farmers around the world are reducing fertilizer use in favour of organic farming, many are still heavily dependent on fertilizer to achieve profitable yields.

CLIMATE AND LABOUR

Climate change has begun to have a tangible impact on the cost and viability of coffee production. Unpredictable weather patterns around harvest and during coffee drying have impacted cup quality and areas previously suitable for coffee production are now being converted to other crops. Higher temperatures, higher rainfall and soil erosion are increasing the risks associated with coffee-growing: yields are lower, infrastructure may be damaged and plants are more vulnerable to disease. All of these factors result in higher risk and higher costs to producers.

Brazilian coffee farms have experienced a cruel combination of frosts and drought for the second year in a row. It can take up to three years for coffee plants to recover from extreme drought, so the disastrous impact is not limited to these two harvests. Brazil’s 2022 arabica crop is predicted to be the lowest since 2016/17. Our grower-owned export partner Sancoffee in Minas Gerais have told us that they expect to have about 50% less exportable coffee than in a “normal” year.

LOGISTICS NIGHTMARE

It’s no secret that international logistics industries are in turmoil, driven by corona-related delays and Russia’s war in Ukraine. We are seeing the impact of the logistics crisis on green coffee prices and availability every day.

The lockdown of the world’s ports, combined with an increased demand for e-commerce during 2020 and 2021 has resulted in a gigantic congested mess of shipping containers. Shanghai is the world’s busiest container port, and it has been immobilised by lockdowns well into 2022. Container congestion means that:

-there are simply not enough empty containers in the world to ship goods on time

-once coffees are placed in a container and prepared for export they are delayed and diverted.

Our partners at Cafe Imports tell us that, in Colombia, the shipping cost of an empty container has increased from an average of 2,000USD in 2019 to 10,000USD in August 2021. Whereas previously shipping companies would offer clients contracts several months in advance, ensuring them a container on a certain date and at a certain price, many companies no longer offer pre-reservation, instead offering containers to the highest bidder. The biggest, baddest shipping companies are simply paying more to have their exports pushed ahead in the waiting line, leaving smaller exporters literally pushed out of the way.

According to the European Coffee Federation, the reliability of shipping companies is currently less than 36%. Our most recent booking of approximately 2,000kg of coffee from Colombia has now been delayed 3 times at the Port of Cartagena in the north of Colombia, after it’s position in the port’s waiting line was “rolled over” to a higher paying customer. 2,000kg represents about 8% of all the coffee that we purchase in a year. A coffee being shipped from Kenya that was due to arrive in July has been delayed for three months in Saudia Arabia. In Ethiopia, banks currently have little to no liquidity (in part due to the catastrophic war in the northern region of Tigray), meaning that there is a desperate lack of money to finance exports.

EURO TO US DOLLAR EXCHANGE RATE

Coffee is conventionally traded in USD/lb. This price will then be converted into Euro at the time of contract (when we commit to buying a certain volume of coffee), or the time of release (when we request that the coffee is delivered from the warehouse to our roastery). For the past two decades, the Euro has been consistently higher than the US dollar, meaning that a $14/kg coffee, would often cost as little as 12.50€/kg.

Because the Euro has been consistently declining against the US dollar throughout 2022, we no longer have this convenient price advantage. Right now, a kilogram of green coffee costs the same in euros as it does in US dollars. This results in about a 10% increase in the price we pay for green coffee.

Exchange rate on 22.09.22

WHY ARE VOTE’S COSTS OF PRODUCTION HIGHER?

I don’t believe that we need to say anything here: roasting coffee requires a lot of gas and electricity, and we all know what’s happening with energy prices.

Philipp co-founded Communal Coffee with the aim of reducing our roastery’s energy consumption and environmental footprint, and we’re very happy he did so, considering how 2022 has evolved. Sharing a space with multiple roasteries has already allowed us to increase efficiency. We’ve combined our delivery route with Populus and Caventura to reduce the number of weekly car trips from 3 to 1, for example. We’re also extremely excited about the oh-so-imminent arrival of Communal Coffee’s new roast machine: we’ll soon be able to roast larger batches, meaning that we can spend more time tasting coffee and talking to you.

However, as you will all know, building up a new space takes time, investment, and a few inevitable hiccups. It will still be a while until we can reap the financial rewards of our new home.

WHY DON’T WE JUST BUY CHEAPER COFFEE?

In short: higher green coffee prices are not the farmers’ fault. Most farmers are not reaping higher profits because of the current prices. If we suddenly source cheaper coffees from different producers or demand lower prices from the same producers we would undercut the most important people in the industry during a vulnerable time.

We believe that we all should pay decent prices for coffee and we will honour our commitments to producers whose coffees we love. Over the next 5 years, we aim to source 85% of the coffee we roast from producers who we work with every harvest, leaving room for us to introduce new coffees and experiment with some funky flavours. By consistently purchasing coffee from the same farms and cooperatives we hope to be a responsible and reliable business partner as coffee growers weather the risks associated with climate change and volatile economic markets. What’s more, we’ll learn more about each coffee year after year, meaning that our roasts should become consistently more delicious.

REALISTIC PRICES, NOT ELITIST PRICES.

That said, we hope to remain an accessible roastery for cafe owners and coffee consumers too. We’ve all worked in cafes and know that it can be a tough grind. We don't believe in exclusivity or elitism. We will always share the reasoning behind the prices we charge as we navigate a changing industry.

Our offering will always include coffees at a variety of price points. This is one of the key reasons why we have purchased two lots from Mustefa Abakeno, for example. His grade one lots are absolutely superb, and his grade two lots are tasty, respectable coffees which we can offer at a more accessible price. We will aim to always have the Cafeina and at least one other price-accessible coffee (like Mustefa’s Grade 2 lot) on our offer list at all times.

THANK YOU.

It’s hard to express sincerity in a newsletter, but we hope that we can share that we are genuinely grateful to be working with you. Thank you for taking the time to read this, please share it with your team. I hope that this newsletter has helped to clarify a little about the wild world that is the coffee industry, and that it offers an honest representation of where we stand as a roastery and a supplier. We appreciate and need your feedback (glowing and growling) so please do send it to us.

We’re glad that we get to share caffeinated seeds that have been taken from cherries then fermented, dried, shipped halfway across the world, cupped, roasted, and ground with you (and we wonder why this industry is complicated!). Keeping you up to date with roastery life and the changes that we witness in the coffee industry is one of the most interesting aspects of our job. If you would like to talk to us or would like resources to share with your customers about price increases, please do let us know.

Do not hesitate to reach out.

With love,

Laurel, Philipp, and David